nebraska tax withholding calculator

Switch to Nebraska hourly calculator. The value of the Nebraska allowance is.

As an employer in Nebraska you have to pay unemployment insurance to the state.

. A financial advisor in Nebraska can help you understand how taxes fit. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Payroll check calculator is updated for payroll year 2022 and new W4.

The Nebraska Department of Revenue is responsible for publishing the. Nebraska State Unemployment Insurance. The State of Nebraska has introduced a State Form W-4N to claim marital status and exemptions for State withholding purposes effective January 1 2020.

2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. Nebraska State Tax Calculator Tax Calculator The Nebraska tax calculator is updated for the 202223 tax year. The income tax withholdings for the State of Nebraska will change as follows.

If youre a new employer congratulations on getting started you pay a flat rate of 125. Read listed below to learn more about it in addition to. October 14 2021 Effective.

Details of the personal income tax rates used in the 2022 Nebraska State Calculator are published below the. Check the 2022 Nebraska state tax rate and the rules to calculate state income tax 5. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Nebraska residents only.

The Nebraska State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Nebraska State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Calculate Nebraska State Income Tax Manually. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. The lowest tax rate is 246 and the highest is 684. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES.

Use tab to go to the next focusable element. State copies of 2021 Forms W. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each employee in a calendar year.

There are no local income taxes in Nebraska. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Nebraska tax withholding calculator Nebraska Withholding Tax.

Nebraska Withholding Tax Federal Withholding Tables 2021 is the process called for by the United States federal government in which companies deduct tax obligations from their employees pay-roll. Pay Period 20 2021. Form W-3N Due Date.

If you like to calcualte state tax withholdings manually you can refer to the Nebraska tax tables. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. It is not a substitute for the advice of an accountant or other tax professional.

No action on the part of the employee or the personnel office is necessary. 691 rows In 2012 Nebraska cut income tax rates across the board and. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. Income Tax Withholding Reminders for All Nebraska Employers Circular EN. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State.

By the quantity of cash being held back the employees have the ability to claim tax returns credit history. The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska income tax withholding. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

TAXES 21-28 Nebraska State Income Tax Withholding. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022. And step by step guide there. Offices are open early and late through April 18 online filing available 247.

The Single or Head of Household and Married taxable withholding tables have changed. There are four tax brackets in Nevada and they vary based on income level and filing status. Nebraska Withholding Tax Federal.

Calculate your state income tax step by step 6. All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022. If you need to create the paychecks and paystubs by entering the federal and state tax amount you can refer to this article How to Generate After the Fact Paychecks with Stubs.

Nebraska Salary Paycheck Calculator. August 5 2021 by Kevin E. The annual exemption amount per withholding allowance has changed from 1960 to 2080.

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Paycheck Tax Withholding Calculator For W 4 Form In 2021

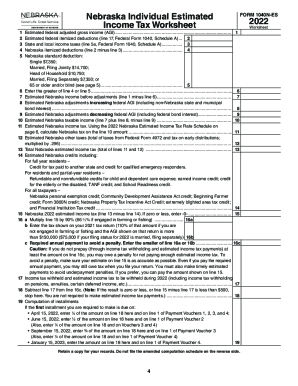

Nebraska Estimated Tax Payments 2021

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Income Tax Calculator Estimate Your Refund In Seconds For Free

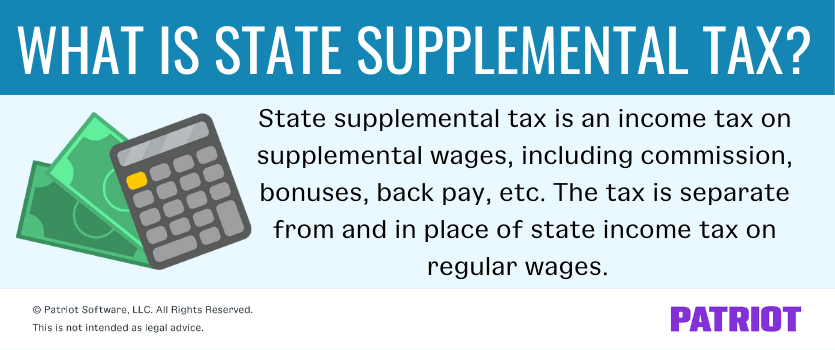

Supplemental Tax Rates By State When To Use Them Examples

Nebraska Paycheck Calculator Smartasset

Nebraska Income Tax Ne State Tax Calculator Community Tax

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State W 4 Form Detailed Withholding Forms By State Chart

Nebraska Income Tax Ne State Tax Calculator Community Tax

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef