tax strategies for high-income earners 2020

If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution. Income in excess of 400000 may classify you as a high-income earner and subject you to higher tax rates.

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

In case you claim a trade changing your trade structure can be a really successful charge lessening technique for high-income workers.

. To reduce your reportable income you should start with maxing out your pre-tax 401k. 6 Tax Strategies for High Net Worth Individuals 1. The law allows you to give up to 60 of your adjusted gross income and deduct it on one tax return.

After age 59-½ in the event that youve met the five-year run the show Roth dispersions are for the most part tax-free. The law permits you to deduct the amount you deposit into a tax-certified retirement account from your tax return. Effective tax planning with a qualified accountanttax specialist can help you to do that.

A donor-advised fund DAF is an investment account created to support charitable organizations. Here are a few options. Do Your Investments Align with Your Goals.

Max your pre-tax 401k. All told workers earning at least 137700 will. If your adjusted gross income AGI on line 11 is above 150000 then you need to at least withhold 110 of your 2020 total tax obligation.

If your work or assets generate significant income you could pay up to half of your earnings to the US. You make your contributions with pre-tax dollars as the money is deducted from your payroll. According to the IRS high-income earners pay almost 70 of the total federal income tax they collect.

To be clear I dont mean the additional amount you had to fork over when. 9 Ways for High Earners to Reduce Taxable Income 2022 1. But there is a way around the regulations and it is perfectly legal.

However in 2021 The Taxpayer Certainty and Disaster Tax Relief Act of 2020 allows individuals to give 100 of their adjusted gross income to a charity or charities during 2021. Typically high-income earners cannot contribute or open a Roth IRA because there is an income restriction. Employer-based accounts such as 401 k and 403 b accounts allow you.

July 24 2020 225242. Visit The Official Edward Jones Site. Lets start with retirement accounts.

Grab your 2020 tax return and your most recent pay stub. The main reason is that youre able to recover the cost of income-producing property through the use of depreciation. Thats why its one of the most popular tax reduction strategies.

Any more than that and the donation will be carried forward on future tax returns. Well need a couple of things for this. How to Reduce Taxable Income.

A Roth retirement account has its own benefits but it wont reduce your income this year. Effective tax strategies for high-income earners should include managing the timing of large gains so you arent subject to the Medicare surtax or pushed into the 20 capital gains bracket. Most employers will give you the option of a pre-tax or a Roth 401k.

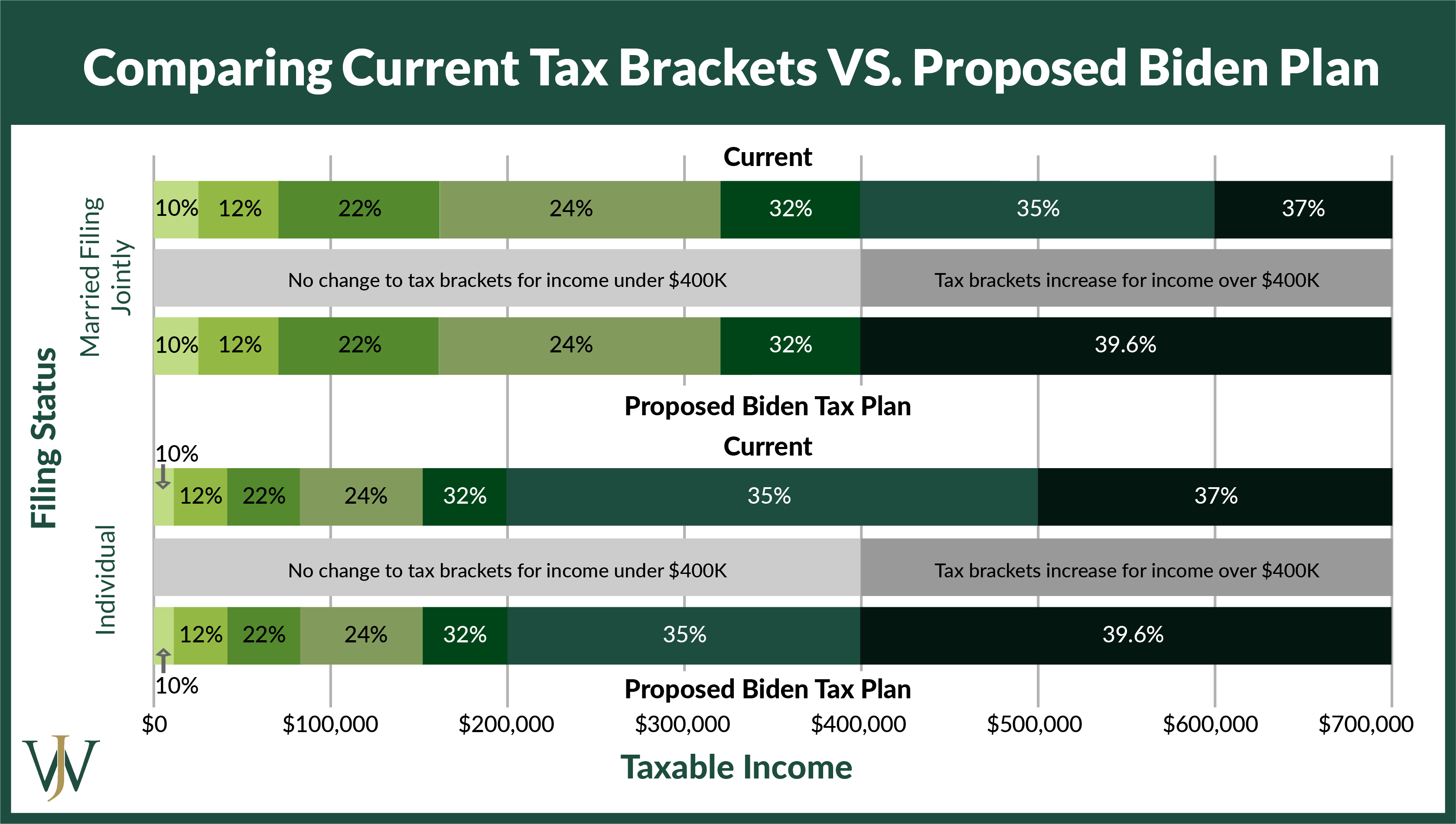

It is unclear how the other brackets would be adjusted but top earners c ould see an increase from 37 to 396. You may give up to 15000 30000 if you are married to as many individuals as you wish without paying federal gift tax so long as your total gifts keep you within the lifetime estate and gift tax exemption of 117 million for 2021. One of my favorite tax strategies for high income earners is investing in real estate.

Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. Sell Inherited Real Estate. If you earn 139000 or more as an individual or you make 206000 or more as a couple you cannot contribute to a Roth IRA.

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of current and future year contributions and deduct them all in the current year. These contributions are not part of your gross income and are therefore not subject to income taxes. Max Out Your Retirement Contributions.

Expert Tax and IRS Solutions. Convert your conventional SEP or Straightforward IRA to a Roth. But the wage base is climbing to 137700 in 2020 which means higher earners will lose more money in the coming year.

Creating retirement accounts is one of the great tax reduction strategies for high income earners. In 2006 Obwalden changed its tax code and introduced falling marginal tax rates for incomes beyond 300000 Swiss francs CHF. Learn How EY Can Help.

With a DAF you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time. New Look At Your Financial Strategy. How to reduce taxable income for high earners through your employer benefits.

If your adjusted gross income AGI on line 11 is above 150000 then you need to at least withhold 110 of your 2020 total tax obligation. Here are some techniques to manage your gains. The IRS allow owners of resident occupied real estate to depreciate property over 275 years.

1 Managing through the annual gift tax exclusion can involve a complex set of tax rules and regulations. The goal explicitly was to attract high-income taxpayers and this was to be achieved through the introduction of a regressive income and wealth tax schedule. Here are the 2020 fiscal year numbers.

One of my favorite tax strategies for high income earners is investing in real estate. Build an Effective Tax and Finance Function with a Range of Transformative Services. Find a Dedicated Financial Advisor Now.

In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. Additionally you are not required to pay taxes on investment earnings from retirement accounts until you actually withdraw them.

Lets start by reviewing 1040 on your 2020 tax return. Ad Top-Rated Tax Relief And Tax Resolution Experts. The plan also includes the.

T he top income tax bracket c ould revert to 396 which was the rate before the 2017 Tax Cuts and Jobs Act. Ad Corporate Tax Services and Solutions from EY.

How Fortune 500 Companies Avoid Paying Income Tax

Personal Income Tax Brackets Ontario 2021 Md Tax

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Budget 2020 Dividend Distribution Tax Scrapped But Shifts The Burden To The Recipients High Income Earners To Bear Th Dividend Higher Income Dividend Income

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How The Middle Class Has Benefited From The U S Tax System For Decades The Washington Post

Taxes Payable By Individuals At Various Income Levels Ontario 2017 Md Tax

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

The 4 Tax Strategies For High Income Earners You Should Bookmark